What Optimization Means For You

90% conversation not 90% calculation. Retirement Optimizer uses advanced algorithms to provide optimized plans for you, so you can spend more time engaging with clients.

Optimize Financial Plans

Go beyond common strategies and rules of thumb. Our software delivers optimized withdrawal strategies that increase net estate value and tax efficiency while calculating ideal start ages for CPP, OAS, and RIF/LIF.

Save Time

Generate the best plan at the click of a button. Make adjustments in real-time as clients' goals, priorities, and risk tolerance change.

Prospect and Retain Clients

Stand out with better plans for your clients than the competition. Deliver tailored decumulation plans and incorporate client changes in minutes, not days. Attract new prospects with data-driven insights and demonstrable results.

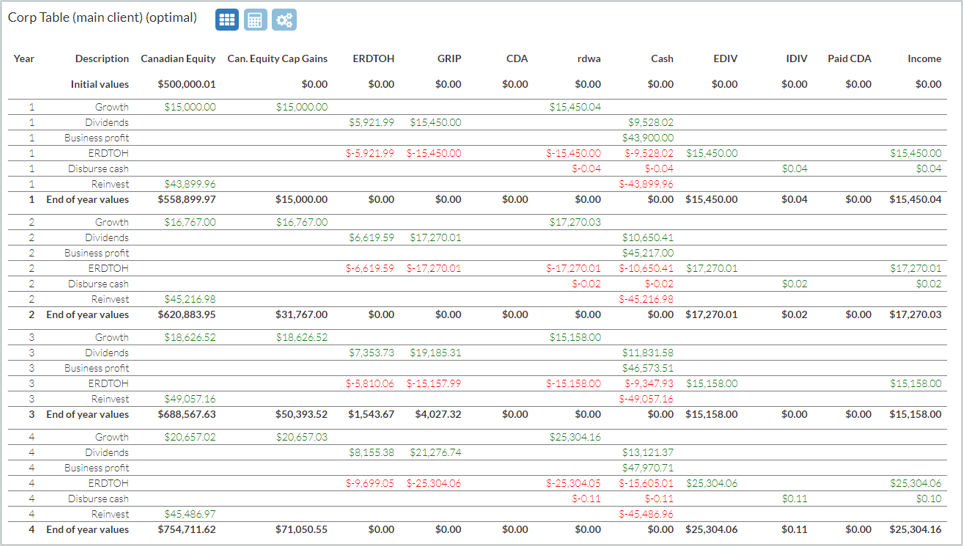

Corporate Accounts

High-net-worth clients have complex corporate and personal wealth profiles that demand sophisticated planning. With AI-driven optimization seamlessly integrate corporate distributions (capital dividends, eligible dividends, ERDTOH refunds) with personal accounts to create industry leading decumulation plans.

Features

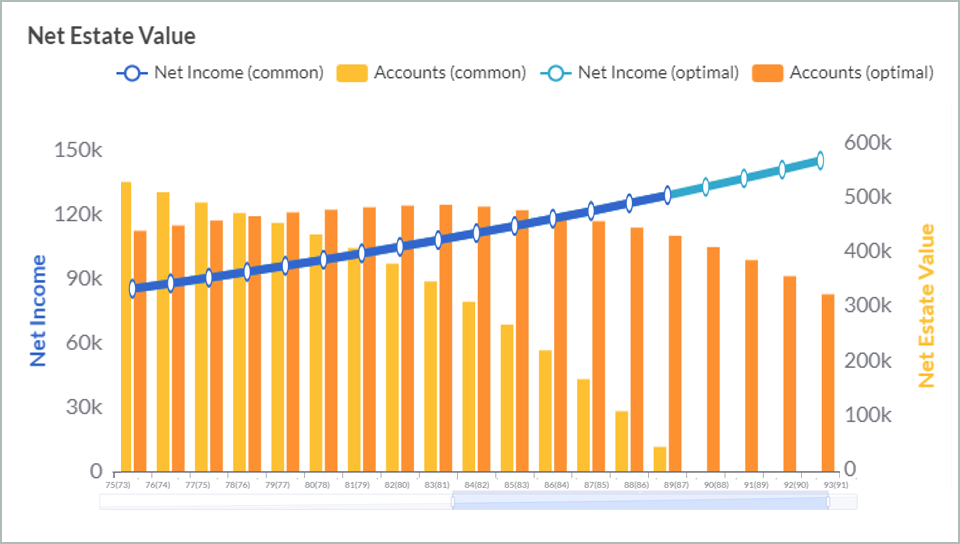

Compare Plans

View as many plans as you need with side-by-side tables and graphs for easy comparison.

Corporate Accounts

Handle complex portfolios that combine personal and corporate wealth to generate an optimized plan with year-by-year steps.

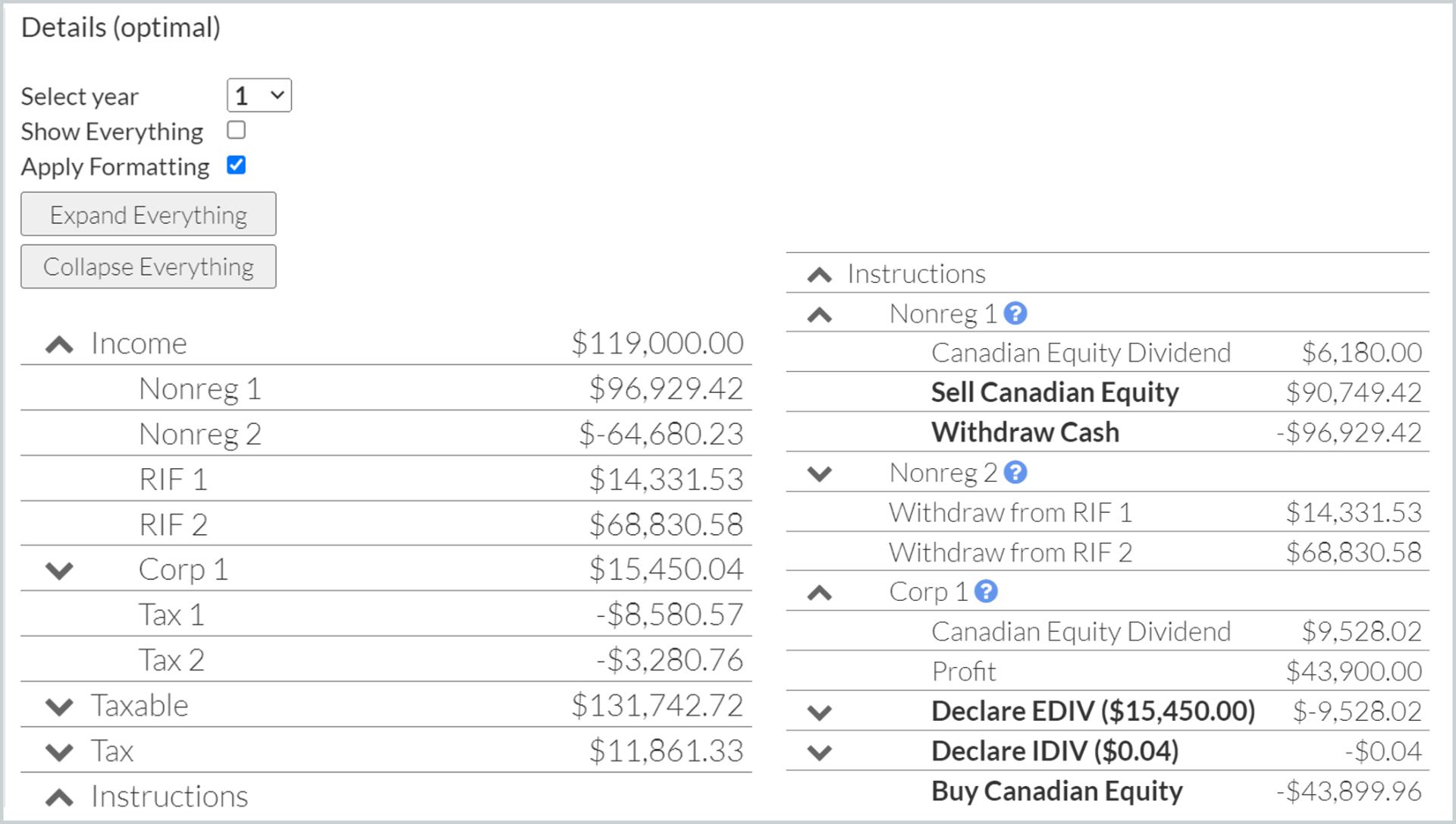

Details Table

Easily provide step-by-step instructions to clients for every year of the financial plan, such as withdrawals and reinvestments for the particular year selected.

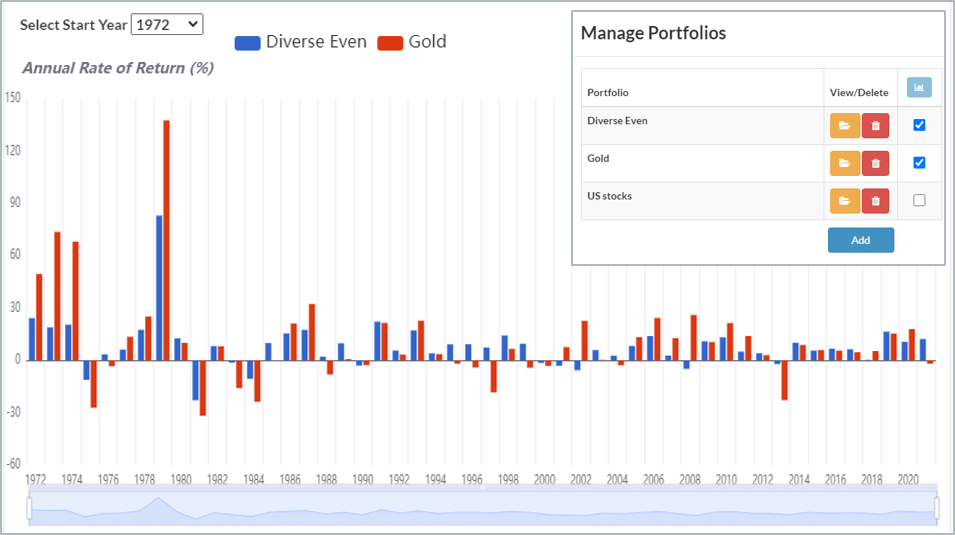

Simulate Against Benchmarks

Back-test and compare your clients' portfolio's survivability to historical market conditions with more than 70 years of market data.

Comprehensive Reporting

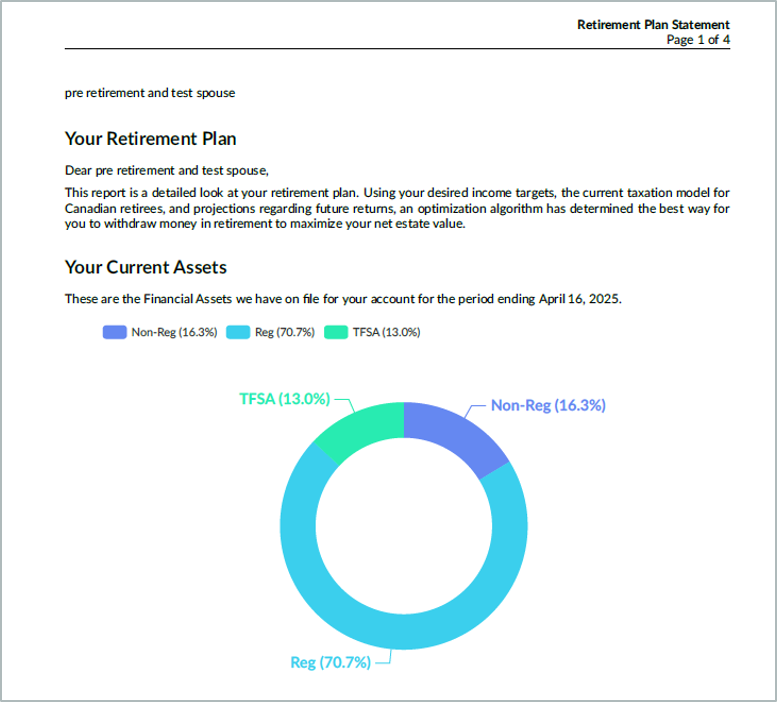

Generate customizable reports for clients, selecting which tables and graphs you would like to include.

How We Differ

Compute The Best Solutions Automatically

Optimization in Relation to Each Aspect

Spending Amounts

CPP, OAS and LIF Age

TFSA Contribution

Corporate Accounts

Non-Reg Accounts

Assets (Mortgage)

| Feature | Competitors |

|---|---|

| Spending Amounts | Manually Set |

| CPP, OAS and LIF Age | Manually Set |

| TFSA Contributions | Manually Set |

| Corporate | Manually Set Distributions |

| Non-Registered | Manually Withdraw in Ordered Fashion |

| Downsize | Manually Generate |

| Reverse Mortgage | Manually Generate |

| Time Spent Creating a Good Financial Plan | Multiple Manual Attempts |

Pricing

Client

For individuals managing their retirement planning

- 1 user/client

- Unlimited trials and modifications

- 1 year storage

- Live help desk support during business hours

Listed prices do not include HST

Subscriptions do not renew automatically. We will send a reminder email 1 month before your subscription(s) expire.